Tariffs can significantly affect climate tech infrastructure buildout—positively or negatively—depending on where they fall and how companies respond. Here’s a breakdown of the impact:

Negative Impacts

- Increased Equipment Costs

- Tariffs on imported solar panels, batteries, inverters, or EV components (e.g., from China) can raise project costs by 10–30%, affecting solar, storage, and electrification efforts.

- Higher costs can delay or cancel utility-scale and distributed energy projects due to strained return on investment (ROI) calculations.

- Supply Chain Disruptions

- Developers reliant on global suppliers may face delays or limited access to key components (e.g., lithium-ion batteries or critical minerals).

- Projects under tight timelines (e.g., due to tax credit deadlines) may miss commercial operation targets.

- Reduced Competition

- By limiting the pool of suppliers, tariffs may reduce competition and innovation, leading to price inflation and stagnation in product improvement.

Positive/Strategic Impacts

- Boost to Domestic Manufacturing

- Tariffs can stimulate U.S. manufacturing of solar panels, battery cells, transformers, and EV chargers—key for the Inflation Reduction Act (IRA) incentives.

- Creates new climate manufacturing jobs and potentially stabilizes supply chains long-term.

- IRA + Tariff Synergy

- Combined with IRA tax credits and domestic content bonuses, tariffs can redirect capital to U.S. suppliers, accelerating domestic infrastructure buildout for:

- Solar PV manufacturing

- Battery storage gigafactories

- Grid modernization components

- Combined with IRA tax credits and domestic content bonuses, tariffs can redirect capital to U.S. suppliers, accelerating domestic infrastructure buildout for:

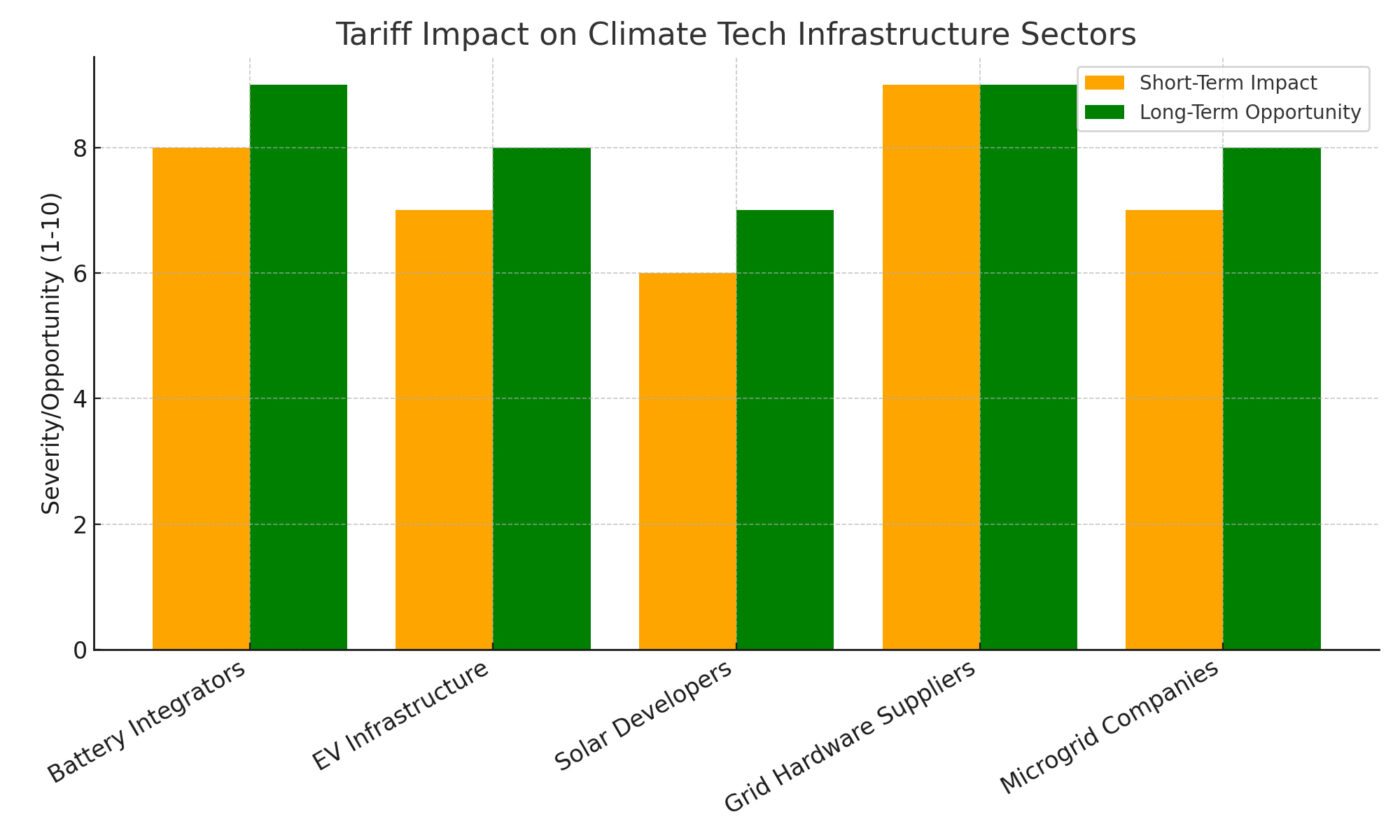

Key Climate Tech Sectors Affected

- Solar (PV): Most vulnerable to module and inverter tariffs

- Battery Storage: Tariffs on cells/modules impact C&I and utility storage

- EV Infrastructure: Charging stations depend on imported components

- Grid Infrastructure: Transformer and semiconductor tariffs can raise costs and slow interconnection timelines

Net Effect?

- Short term: Headwinds for project developers, especially small to midsize firms without access to domestic suppliers

- Medium/long term: Opportunity for reshoring and resilient, regionalized climate tech ecosystems

Use Case: Battery Integrators

Battery integrators sourcing cells and inverters overseas are facing increased costs and long lead times. While this disrupts near-term project timelines, it’s accelerating interest in U.S.-based suppliers. For example, some integrators are pivoting to partnerships with emerging U.S. cell manufacturers to ensure IRA compliance and avoid tariff penalties.

Where Sea Change Has Helped

We’ve supported battery and storage companies navigating this exact transition—finding executive and engineering talent with the technical depth and U.S. market knowledge to shift procurement, redesign supply chains, and scale local production.