The CEO of cleantech recruiter Enertech Search says a CCO or CRO can be the best-kept secret of success during early commercialization.

The article below was first published in Greentech Media.

The global smart-grid market is expected to cumulatively surpass $400 billion worldwide by 2020, according to GTM Research. That’s an average compound annual growth rate of over 8 percent. But this growth is not happening five years from now; it’s happening today. Companies have been feeling it over the past two years. Along with this growth, this industry, like other technology-driven sectors, is starting to see the lines between marketing and sales blur as firms try to stay one step ahead of market shifts and fierce competitors.

Today, new opportunities require an integrated commercial approach, and leadership roles that combine these activities are increasingly prevalent. More and more, CEOs need a single point of contact on the commercial side: someone who can manage innovation, product development, marketing and sales — on a large scale, across all platforms, in both the digital and bricks-and-mortar realms. Thus, the typical VP of sales position is starting to take a backseat to the rise of the smart grid chief commercial officer (CCO) and chief revenue officer (CRO).

Smart-grid companies like Vigilent and Varentec have utilized the CCO role to great effect in recent years. Most recently, Enbala attracted Trent Bowers away from Landis+Gyr. It’s a trend building in solar and energy storage markets as well, with CCO roles found at Yingli,Stem, Soligent, NEXTracker and Advanced Microgrid Solutions, to name a few.

CCOs fill in the gaps

In the traditional sense, the VP of sales role is about execution. A strong VP of sales is deft at driving the team toward reaching preset targets, with predetermined customer audiences. These highly qualified men and women know how to manage effective sales teams, support them with execution tactics, and step in at key points in the sales process to ensure that deals close. Yet in an early-stage company, even the top talent in this field must often still depend on the CEO to design and define the go-to-market strategy to begin with.

Beyond commercialization, CEOs have many other responsibilities during this critical growth time, not the least of which is fundraising. CEOs can and do perform both responsibilities, but dividing their attention between overseeing commercialization strategies and closing funding rounds can slow a company’s ability to grab market share before it reaches the end of the runway. Thus, for many companies, a CCO or CRO can be the best-kept secret of success during early commercialization.

The CCO/CRO can take the weight of developing and implementing commercialization strategies, quarterbacking critical deals, and making strategic sales pivots to capture last-minute opportunities. In a way, they are a bridge between the CEO’s commercialization vision and its execution in real-world situations, particularly in the absence of a COO. Later, other positions, such as the VP of sales, can be filled to assist the CCO/CRO in building out the strategy and implementing it as the company scales.

“Transforming into a high-functioning commercial organization requires a strategic vision for how sales, marketing, policy and product management come together in complete alignment with the voice of the customer,” said Stem CCO Karen Butterfield. “A successful CCO…facilitates the CEO’s focus on fundraising and market evangelizing during these high-growth years of a company.”

More and more emerging smart-grid companies are realizing what Stem and other innovative companies have deduced — that taking full advantage of a late-stage startup’s growth years requires sales leadership that can orchestrate a variety of revenue-generating operations that resonate with the customer.

Unfortunately, at the same time, the majority of these companies are still labeling this role as a VP of sales. This has them being passed over by candidates perfect for the job, but who are looking for something larger than just another VP of sales role, and attracting those who just don’t measure up to the expanded requirements. Redefining the VP of sales function into a CCO role can make the position more attractive to the “A players” with the combination of product, sales, commercial, and regulatory experience, and those who’ve also already held VP of sales roles.

The new CCO at Varentec is a perfect example. At the beginning of this year, Varentec asked us to find them a stellar VP of sales. Among the first round of candidates presented was Mehrdod Mohseni, then CEO at UISOL, an Alstom Grid company. He had been on our radar as an impressively qualified candidate, and we knew he would move given the right opportunity.

Varentec agreed that he was perfect for ensuring they could meet their sales goals today, as well as four years from now. However, the VP of sales position, as it was defined, was too small to take advantage of all the operation and leadership expertise Mohseni could bring to the company, so Varentec kept looking. After several more rounds of VP of sales candidates, it became clear that the professional experience Mohseni could provide Varentec beyond execution was highly desirable and worth more consideration.

By hiring Mohseni in a C-suite role that encompassed operations, sales and marketing, Varentec was able to secure a stellar executive who could fill in the gaps they had, while also driving continued revenue growth. Additionally, in our view, Mohseni’s background as a divisional CEO provided the company with a leader who could fill in the operational gaps that would normally fall under a COO as needed in the short term.

Practicalities in timing and compensation

Traditionally, companies wait until their commercial operation is more mature (post-Series C) to secure a CCO/CRO. However, the trend is growing to hire this strategic leader earlier, often during the Series B round. Establishing the CCO/CRO position early (in lieu of filling a VP of sales) can set up Series B companies for greater success in the long run. CCOs/CROs can be more hands-on earlier in the company’s development and shape the short- and long-term commercial strategies, versus only reacting to the immediate opportunities in front of them.

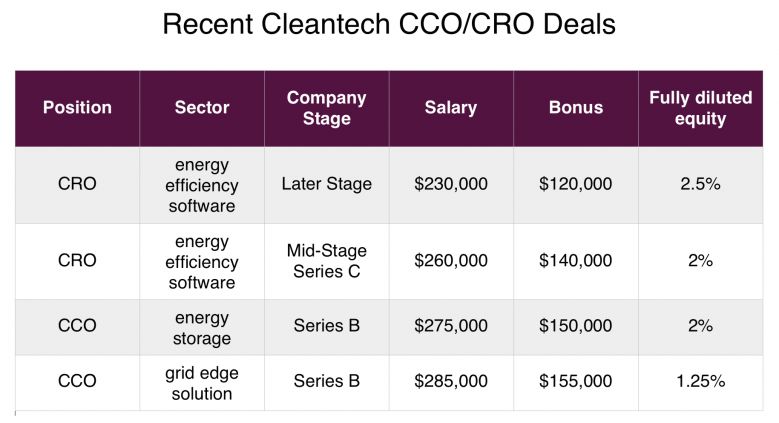

In the market today, we are seeing smart grid CCO and CRO salaries ranging from $230,000 to the high $285,000, with signing bonuses from $50,000 to over $150,000. Additionally, companies can sweeten the deal and secure in-demand candidates quickly by offering equity, and additional bonuses to protect candidates from pending commissions they may lose by switching companies.

For any technology, the market is constantly shifting to match the source of demand and gain a competitive edge, and hiring strategies are no different. In cleantech commercialization, from solar to grid edge, companies need to expand their lens to encompass a chief commercial or chief revenue officer early on. In doing so, they have the opportunity to optimize their team to take full advantage of their growth potential. At the same time, they can attract the “A players” who are hungry to take new companies to extraordinary heights.

Placing a CCO/CRO at the Series B stage can be a bold move, and it’s one that pays dividends for the forward-thinking companies willing to be leaders in the market.